Unravelling household financial assets and demographic characteristics: a novel data perspective

Unravelling household financial assets and demographic characteristics: a novel data perspective

Unravelling household financial assets and demographic characteristics: a novel data perspectiveAbstract

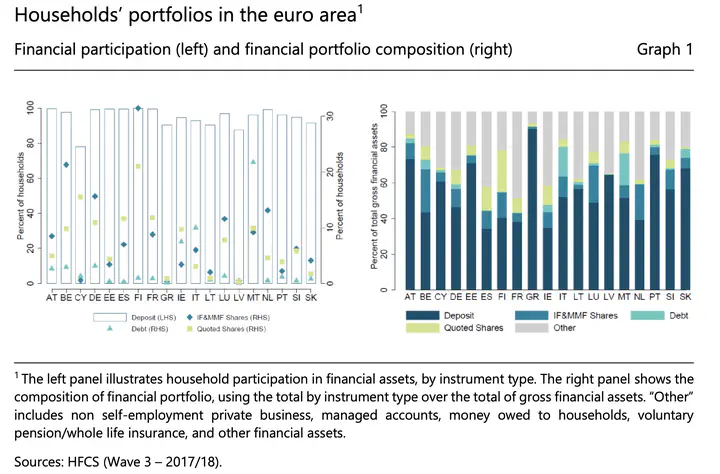

This paper presents a novel dataset that combines granular information on financial assets from the Security Holdings Statistics (SHS) with household characteristics from the Household Finance and Consumption Survey (HFCS). We illustrate one of its potential uses by studying the link between portfolio returns and risk with education. First, we provide a non-parametric exercise taking Ireland as a case study and report a robust link between high education levels and returns. Moreover, we find that more educated households exhibit higher risk tolerance and portfolios structured to realise greater gains in periods of elevated positive risk, albeit being more susceptible to losses in challenging times. Second, we expand the illustrative example to a country panel setting and address the previous question following non-parametric as well as parametric methods. Interestingly, the previous results for education and returns also emerge in this setting. These are robust to the inclusion of unobserved conditioning factors and macro-financial controls. We outline avenues for potential research and analysis that our novel dataset may contribute to in the future.