Dynamic central bank independence indices and inflation rate: A new empirical exploration

Inflation 💸 and Central Bank Independence 🏛️

Inflation 💸 and Central Bank Independence 🏛️Abstract

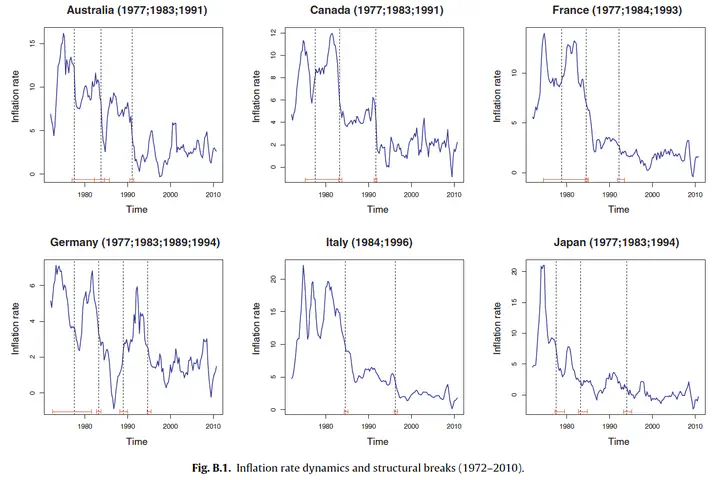

It has been argued that economies with more independent central banks experience lower inflation over time. In this paper we show that this relationship is sensitive to the methodology through which central bank independence indices are constructed. We stress the importance of employing dynamic central bank independence indices in two ways. First, we perform unit root tests with structural breaks to verify if the implementation of central bank reforms represents a structural break for the inflation rate dynamics. Second, we implement a panel data analysis. We find evidence that legislative reforms that modify the degree of independence of a central bank have a strong impact on the inflation rate dynamics. Moreover, underlying the importance of employing dynamic central bank independence indices, we confirm the negative relationship between the latter and inflation for a sample of 10 OECD countries.