Did financial frictions stifle R&D investment in Europe during the great recession?

🔬 R&D & Crisis 🕵

🔬 R&D & Crisis 🕵Abstract

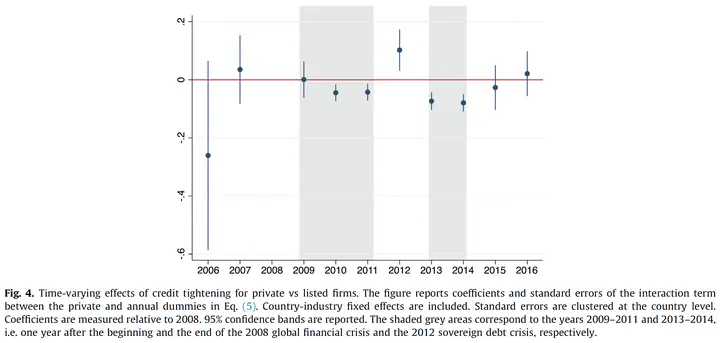

We investigate the role of financial frictions in R&D spending in a large sample of European firms. Our identification strategy exploits the contraction in credit supply that followed the 2008–09 global financial crisis and 2012 Euro area sovereign debt crisis, together with differences in financial frictions across firms and industries to identify a causal effect of financial constraints on investment in innovation. We show that firms that are more likely financially constrained, in industries more dependent on external finance, invest disproportionally less in R&D during periods of tight credit supply. Smaller, private firms with weaker balance sheets also have a lower share of R&D in total investment, suggesting R&D drops more than total investment during these crisis episodes. These results are robust to different proxies of financial constraints and fixed-effects identification strategies.